Will export companies be fined if they fail to go through the tax refund procedures?

6 August 2024

In the intense international trade environment, export companies should not only pay attention to markets and orders, but also to compliance operations. Especially regarding the handling of tax refund procedures, whether the non-processing of the tax refund procedure will be penalized, has become a question of concern for many companies. This article will give you a detailed explanation of the legal consequences that export companies may face if the non-processing of the tax refund procedure, and provide response measures to help companies.

How can an enterprise easily handle the filing of export refund (exemption) tax?

22 July 2024

Export refund (exempt) tax policy is a tax preferential policy provided by the state to promote foreign trade exports. Enterprises must first apply to the competent tax authorities to process export refund (exempt) tax enterprise records before enjoying this policy. This article will detail the conditions and process of application for export refund (exempt) tax filing.

Reveal the factory export tax refund: how to calculate, easy to master!

July 9, 2024

In international trade, tax refunds are an important part of improving the competitiveness of factories. Knowing how to calculate export tax refunds is important for optimizing costs and increasing profits. This article will take you step by step to understand the principle of tax refunds, from the determination of the input tax to the calculation of the amount to be refunded, so that you can understand the process of tax refunds.

[Guide to Avoiding Pits] For the record of export tax rebates, can the FCR documents be used?

15 April 2024

In international trade, properly handling the export tax rebate filing is a crucial step to ensure smooth export operations and the recovery of paid taxes. Particularly when using specific types of shipping documents such as FCR (Forwarder's Certificate of Receipt), understanding its applicability and limitations is essential. This article will provide a detailed introduction to the use of FCR documents for export tax rebate...

How to easily handle export tax rebates?

11 April 2024

Export tax refund is an extremely important fiscal policy for export enterprises in international trade, it can not only enhance the international competitiveness of enterprises, but also improve the financial situation of enterprises and promote trade balance development.The correct understanding of the basic conditions of export tax refund and the attention when choosing suppliers, is crucial to ensure that enterprises can smoothly return tax declarations and reduce fiscal risk.

Export tax refund Filing: Guidelines for Compliance and Preservation of Electronic Purchase and Sales Contracts

March 14, 2024

In international trade, the contract is a legal document that determines the rights and obligations of both buyers and sellers, and for export companies, the contract is not only the basis for transactions, but also one of the key certificates for processing export refund (exempt) taxes and other procedures. With the development of e-commerce, the electronic purchase contract is increasingly widely used, so is it in line with the requirements of the export refund (exempt) tax filing certificate?

Does the non-compliance of major commodity categories affect export refunds?

22 February 2024

When exporting, foreign trade companies often face the case of buying goods from multiple suppliers and declaring exports on the same customs clearance. In this case, the VAT-specific invoices obtained from purchasing goods may show the same product name, but the product categories may not be consistent.

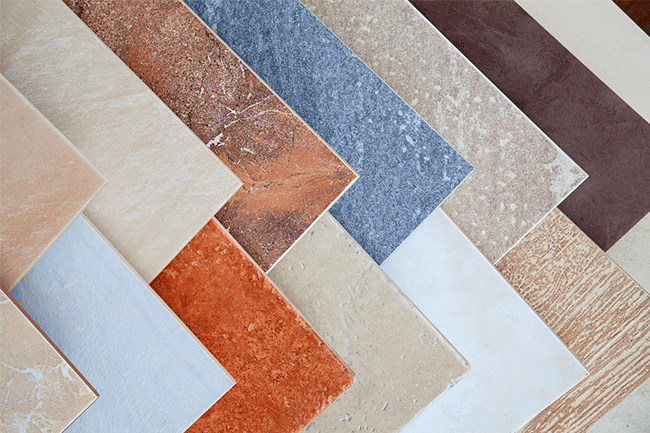

Egyptian ceramic tile import regulations: ensure smooth customs clearance and tax refund

October 19, 2023

For companies that want to export tiles to Egypt, understanding Egypts specific import regulations can not only ensure goods are smooth in customs, but also effectively deal with the issue of tax refunds. This article will detail the relevant regulations of Egypt and their impact on tax refunds. 1, Egypts import and export control measures: ACID system Egypt to strengthen the management of imported goods, from July 1, 2021.

How to deal with inconsistencies between the receiving country and the reporting country

October 19, 2023

When conducting international trade, if the country of exchange and the exporting country are not consistent, the return of taxes may encounter some complexity. Take the customer to pay RMB from Turkey to our department for example, but the project is ultimately for Russia, the terms of trade are FOB, here is the relevant preparation and operation of the return of taxes: I.

![[Guide to Avoiding Pits] For the record of export tax rebates, can the FCR documents be used?](https://pic.zongdaifu.cn/wp-content/uploads/2023/03/2023032906254077.jpg)

Follow Customer Service WeChat

Follow Customer Service WeChat