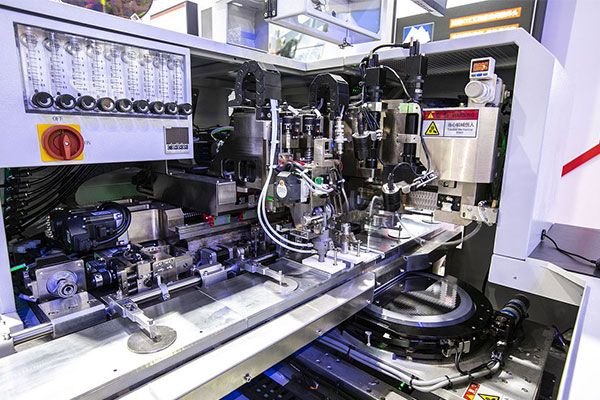

Foreign trade agents areMachineryproviding the following services for imports, covering all aspects from pre - preparation to post - support:

- Demand Analysis and Solution Development:

The agent communicates with the client to determine the variety, quantity, price, quality of the goods and trade terms (such as FOB, CIF). Especially for regulated products (such as medical devices or food), analyze regulations regarding tariffs, value - added tax, etc., to ensure the legality and feasibility of the import plan. For example, the foreign tradeImport agentprocess emphasizes the importance of demand analysis, especially for high - value electronic equipment which may require more stringent inspections. - Contract Signing and Legal Support:

The agent assists the client in signing an import contract with foreign suppliers, clarifying terms of delivery, payment, quality, and insurance. At the same time, sign aImport agentcontract with the client, specifying in detail rights, obligations, agency fees, service content, ownership, risks, and payment methods. According to theExport agentanalysis of the whole process, contract signing is a key step to ensure the rights and interests of both parties. - Payment and Fund Management:

The agent handles payment methods such as Telegraphic Transfer (T/T) or Letter of Credit (L/C). For example, after the customer makes the payment, the agent arranges the fund transfer within 3 working days, and the Letter of Credit can be processed within 3 - 5 working days. When settling the funds, after deducting transportation, insurance, inspection, and agency fees, the net amount is transferred to the supplier. - Customs Clearance and Document Handling:

The agent is responsible for customs declaration and clearance, including document review, bill exchange, customs declaration, inspection, and electronic tax payment. The complexity of customs clearance varies depending on the product. High - value electronic equipment may require three inspections or more stringent inspections, increasing time and cost. Customs clearance is the core of the whole process, and the agent needs to be familiar with customs policies. - Logistics and Warehousing Services:

After customs clearance, the agent coordinates transportation and warehousing to ensure the safe and timely delivery of goods. According to the clients needs, arrange pick - up, distribution, and warehousing services, and coordinate with freight and storage companies to ensure the safety of the goods.

Detailed Description of Process Steps

The process of importing electromechanical equipment through foreign trade agents can be divided into the following 8 steps, as follows:

| Steps | Description |

|---|---|

| 1. Determine Import Demand Identify the variety, quantity, price, quality of the goods and trade terms (such as FOB, CIF). | 2. Select an Import Agent Choose a professional import customs clearance agent with rich experience and international trade capabilities. |

| 3. Sign an Import Agency Contract Sign a contract with the agent, clarifying rights, obligations, agency fees, and payment methods. | Select a professional import customs clearance agent with rich experience and international trade capabilities. |

| Sign an import agency contract | Sign a contract with the agent to clarify rights, obligations, agency fees, and payment methods. |

| Sign the import contract | The agent signs a contract with the foreign supplier, specifying in detail the terms of delivery, payment, quality, and insurance. |

| Procurement and inspection | The agent is responsible for procuring and inspecting the goods to ensure they meet the contract requirements. |

| Transportation and insurance | The agent arranges transportation and insurance to ensure the safe and timely delivery of the goods. |

| Customs declaration and clearance | The agent assists in handling customs declaration and clearance procedures, including document review, bill exchange, customs declaration, inspection, and tax payment. |

| Payment | The importer pays the agent, and the agent then transfers the funds to the foreign supplier. |

Legal and Regulatory Framework

According to the Measures for the Administration of the Import of Mechanical and Electrical Products, the import of mechanical and electrical equipment shall comply with the following legal and regulatory requirements:

- Definition and classification:

Mechanical and electrical products include machinery, electrical equipment, transportation vehicles, electronic products, instruments, metal products, and their components. Used mechanical and electrical products are defined as equipment that has been used, or equipment with an expired warranty period, obvious wear and tear due to long - term storage, a mixture of new and old parts, or refurbished equipment. - Management structure:

The Ministry of Commerce is responsible for the national import management, and local and departmental offices are responsible for regional management. - Import classification:

Imports are divided into three categories: prohibited, restricted, and free. Reasons for prohibited imports include national security, public interest, health, safety, environmental protection, and international agreements. Reasons for restricted imports include national security, health, environmental protection, and industrial development, and a license is required for import. Some free - imported products require an automatic license for supervision. - License management:

Restricted import products require a license, and the processing time shall not exceed 20 days at most. The list of automatic licenses needs to be announced 21 days in advance. - Legal liability:

Acts such as unauthorized import, import beyond the scope, and forgery of documents are prohibited, and violators may face criminal liability. - Special circumstances:

There are specific exemptions for special situations such as processing trade, foreign investment, leasing, and donations. For example, imports within the total investment amount or samples worth less than 5,000 yuan are not subject to the management measures.

The above framework indicates that the agent needs to assist the client in obtaining a license to ensure compliance, especially for used mechanical and electrical equipment or regulated products.

Precautions and Costs

- Regulated products: Some mechanical and electrical equipment, such as dual - use items or high - value electronic equipment, may require additional licenses or more stringent inspections. The customs clearance time and cost may vary depending on the product type.

- Used mechanical and electrical equipment: According to the interpretation of the import policy for used mechanical and electrical products, the import of used equipment requires special permission, and the agent needs to be familiar with the relevant policies.

- Costs of: The agency fee is usually 1% - 2% of the total price, and the specific fee depends on the product complexity and service content. For example, the foreign trade agency service mentions that the agency fee is between 1% - 2% and should be specified in the contract.

Tags: Import agent · Machinery

Follow Customer Service WeChat

Follow Customer Service WeChat